Welcome to the exciting journey of building your first budget! Whether you’re just starting on your financial wellness journey or looking to revamp your money management skills, creating a budget is a crucial step towards achieving your financial goals.

Step 1: Assess Your Income: Begin by calculating your monthly income. This includes your primary job, side hustles, and any other sources of income. Understanding how much money you have to work with is fundamental to crafting an effective budget.

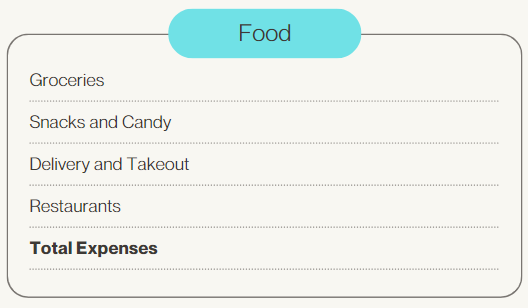

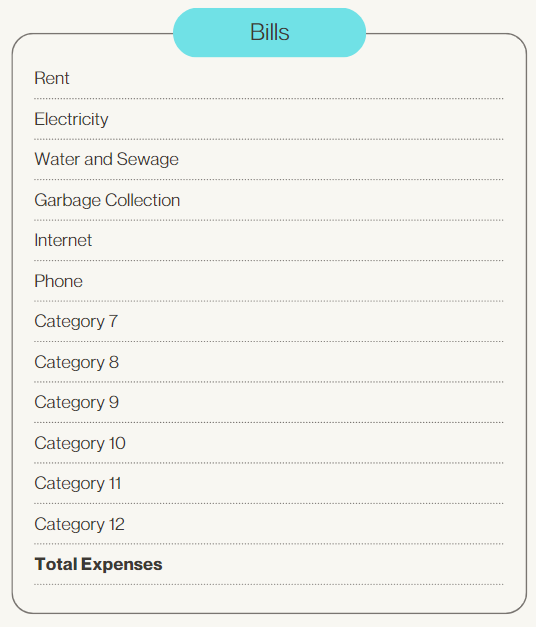

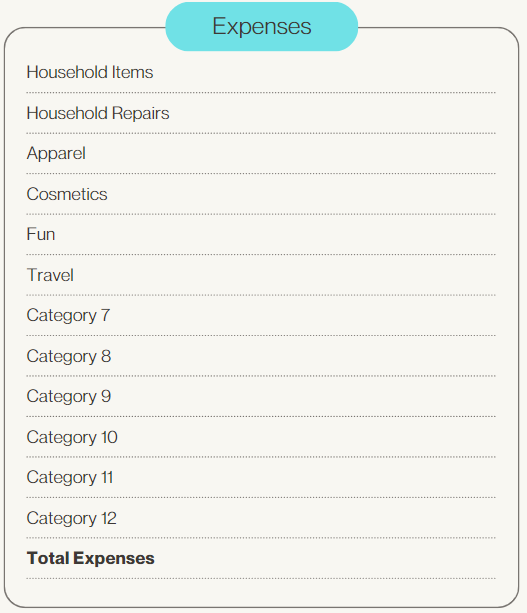

Step 2: List Your Expenses: Create a comprehensive list of all your monthly expenses. Categorize them into fixed (mortgage/rent, utilities) and variable (groceries, entertainment) expenses. Don’t forget irregular expenses like annual subscriptions or quarterly bills.

Step 3: Differentiate Between Needs and Wants: Distinguish between essential needs and discretionary wants. Prioritize your needs while being mindful of your wants. This step helps ensure that your essential expenses are covered before allocating money to non-essential items.

Step 4: Set Financial Goals: Define short-term and long-term financial goals. Whether it’s building an emergency fund, paying off debt, or saving for a vacation, clear goals provide direction and motivation.

Step 5: Create Budget Categories: Segment your expenses into categories based on your lifestyle and spending patterns. Common categories include housing, transportation, food, debt payments, and savings. This breakdown allows for better tracking and adjustment.

Step 6: Allocate Funds: Assign specific amounts to each category based on your income and prioritized needs. Be realistic and ensure that your income covers all necessary expenses. Leave room for savings and discretionary spending.

Step 7: Embrace Flexibility: Recognize that life is dynamic, and your budget should adapt. Allow flexibility for unexpected expenses or changes in income. Regularly review and adjust your budget to stay aligned with your financial goals.

Step 8: Utilize Budgeting Tools: Explore digital tools or apps to streamline your budgeting process. Many platforms offer features like automatic expense tracking, goal setting, and financial insights, making it easier to manage your money.

Congratulations! You’ve taken a significant step towards financial empowerment by building your first budget. Remember, a budget is a dynamic tool that evolves with your life. Regularly revisit and refine it to ensure it aligns with your financial aspirations.

Discover more from Mrs. Becky Bartley

Subscribe to get the latest posts sent to your email.