Hey everyone! Welcome back to our budgeting journey. Today, we’re diving into a crucial topic that can make or break your financial stability: the emergency fund. 🚨💰

Why Do You Need an Emergency Fund?

Life is unpredictable. Unexpected expenses can pop up at any moment, whether it’s a medical emergency, car repair, or job loss. Without an emergency fund, these unplanned costs can quickly lead to debt and financial stress. An emergency fund acts as a safety net, providing you with the peace of mind that you can handle whatever life throws your way.

How Much Should You Save?

Financial experts recommend having three to six months’ worth of living expenses saved in your emergency fund. This might seem like a daunting task, but remember, every little bit helps. Start small and gradually build up your fund. The key is consistency and dedication.

Steps to Building Your Emergency Fund

- Set a Savings Goal: Calculate your monthly living expenses, including rent/mortgage, utilities, groceries, transportation, and insurance. Multiply this by three to six months to determine your savings target.

- Open a Separate Savings Account: Keep your emergency fund in a separate, easily accessible savings account. This helps avoid the temptation to dip into it for non-emergencies.

- Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund. Treat it like a regular bill to ensure you’re consistently adding to it.

- Cut Unnecessary Expenses: Review your budget and identify areas where you can cut back. Redirect those savings into your emergency fund. Every dollar counts!

- Use Windfalls Wisely: Tax refunds, bonuses, and other unexpected income can give your emergency fund a significant boost. Resist the urge to splurge and put these windfalls directly into your savings.

When to Use Your Emergency Fund

An emergency fund is for true emergencies, not for planned expenses or discretionary spending. Use it for situations like:

- Medical Emergencies: Unexpected medical bills, urgent dental work, or emergency vet visits.

- Job Loss: Covering your living expenses while you search for a new job.

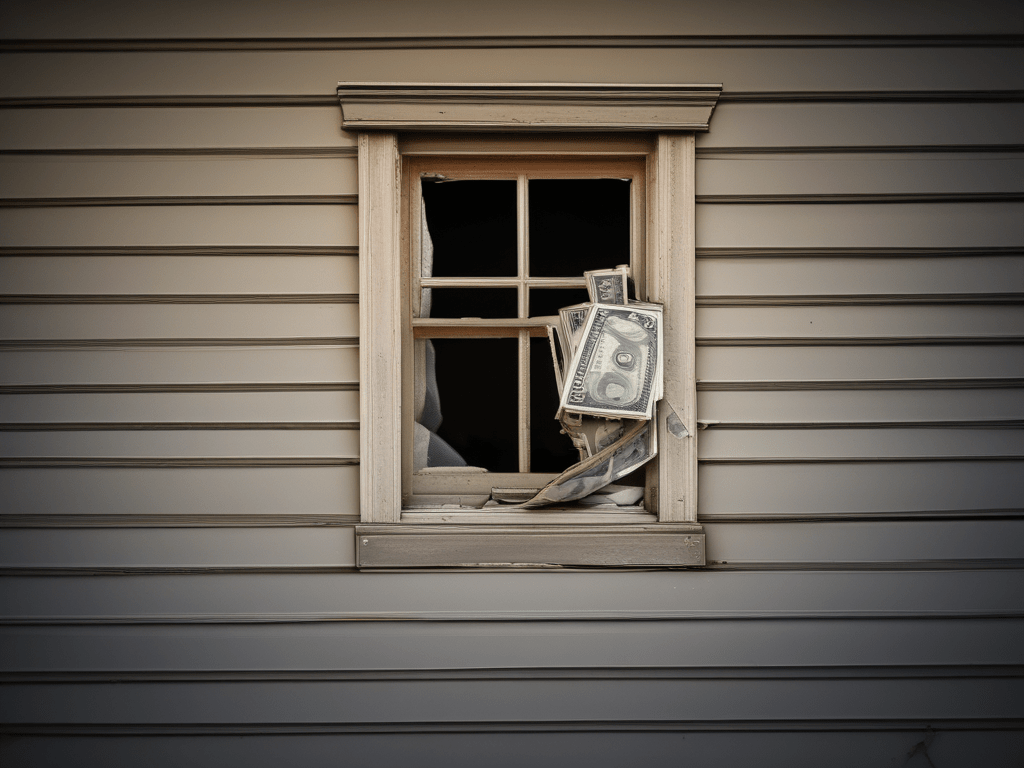

- Home Repairs: Fixing essential home issues like a leaky roof or broken furnace.

- Car Repairs: Major car repairs that are necessary to keep your vehicle running.

Rebuilding Your Emergency Fund

If you need to use your emergency fund, make it a priority to replenish it as soon as possible. Adjust your budget to allocate more funds towards rebuilding your savings until you’ve reached your target amount again.

The Peace of Mind Factor

Having an emergency fund isn’t just about financial security; it’s about peace of mind. Knowing you have a financial cushion can reduce stress and help you make better financial decisions. It prevents you from relying on credit cards or loans in emergencies, which can lead to a cycle of debt.

Real-Life Example

When I was going through my divorce, I faced significant financial uncertainty. With three kids and no stable income, it was a stressful time. But I learned to build an emergency fund that helped me cover essential expenses and gave me the breathing room I needed to get back on my feet. This experience reinforced the importance of having a financial safety net, and it’s a message I share with everyone starting their financial wellness journey.

Consistency is Key

Building an emergency fund is one of the most important steps you can take to secure your financial future. It’s not just about saving money; it’s about creating a buffer that protects you and your family from life’s uncertainties. Start small, stay consistent, and watch your financial security grow.

What steps are you taking to build your emergency fund? Share your progress and tips in the comments below!

Subscribe to

our newsletter

Discover more from Mrs. Becky Bartley

Subscribe to get the latest posts sent to your email.