Estate planning isn’t just for the wealthy—it’s for anyone who wants to ensure their loved ones are taken care of and their wishes are honored. Unfortunately, many people put off estate planning, thinking it’s something they can deal with later. But the reality is that life is unpredictable, and planning now can save your family from unnecessary stress and hardship in the future.

Why Estate Planning Matters

Estate planning is more than just deciding who gets your assets when you pass away. It’s about making sure your wishes are honored, your loved ones are cared for, and your affairs are in order. Without an estate plan, your assets could end up in probate, causing delays, legal fees, and potential disputes among your family members.

The Risks of Not Planning Ahead

Many people assume estate planning is only for the elderly or those with significant wealth, but that’s a common misconception. Here’s what can happen if you don’t have an estate plan:

- Your assets may not go to the people you intended.

- If you have minor children, the courts will decide who takes care of them.

- Probate court can take months—or even years—causing unnecessary stress for your loved ones.

- Your family may face unexpected tax burdens.

- Medical and financial decisions could be left in the hands of someone you wouldn’t have chosen.

Essential Estate Planning Documents

To ensure your estate is handled according to your wishes, there are a few critical documents you should have in place:

- A Will: Outlines how your assets should be distributed and names guardians for your minor children.

- A Trust: Can help bypass probate and ensure a smoother transfer of assets.

- Durable Power of Attorney: Authorizes someone you trust to make financial decisions if you become incapacitated.

- Advance Directive (Living Will): Specifies your medical treatment preferences in case you are unable to communicate them.

- Beneficiary Designations: Ensures your financial accounts and insurance policies are distributed correctly.

5 Biggest Reasons People Fail at Estate Planning

- Procrastination

- Many people delay estate planning because they think they have plenty of time. Unfortunately, unexpected life events can happen at any age.

- Not Updating Documents

- Life changes, such as marriage, divorce, births, or deaths, require updates to your will, trust, and beneficiary designations. Failing to update these documents can result in assets being distributed in ways you never intended.

- Thinking They Don’t Have Enough Assets

- Estate planning isn’t just for the wealthy. Even if you have a modest estate, planning ensures your assets go to the right people and that your wishes are followed.

- Failing to Name Contingent Beneficiaries

- Many people designate a primary beneficiary but forget to add a contingent (backup) beneficiary. If something happens to the primary beneficiary, the assets could end up in probate.

- Not Communicating Their Wishes

- It’s important to discuss your plans with your loved ones so they understand your intentions. This can prevent confusion, disputes, and unexpected surprises.

Getting Started with Estate Planning

Estate planning doesn’t have to be overwhelming. Start by taking these simple steps:

- Make a list of your assets and debts.

- Decide who you want to inherit your assets and who should handle financial and medical decisions if you’re unable to.

- Meet with an estate planning professional to draft the necessary legal documents.

- Review your plan every few years or after significant life events.

Take Action Today

Don’t wait until it’s too late to put your affairs in order. Estate planning is a gift to your loved ones, ensuring they don’t have to deal with legal complications during an already difficult time.

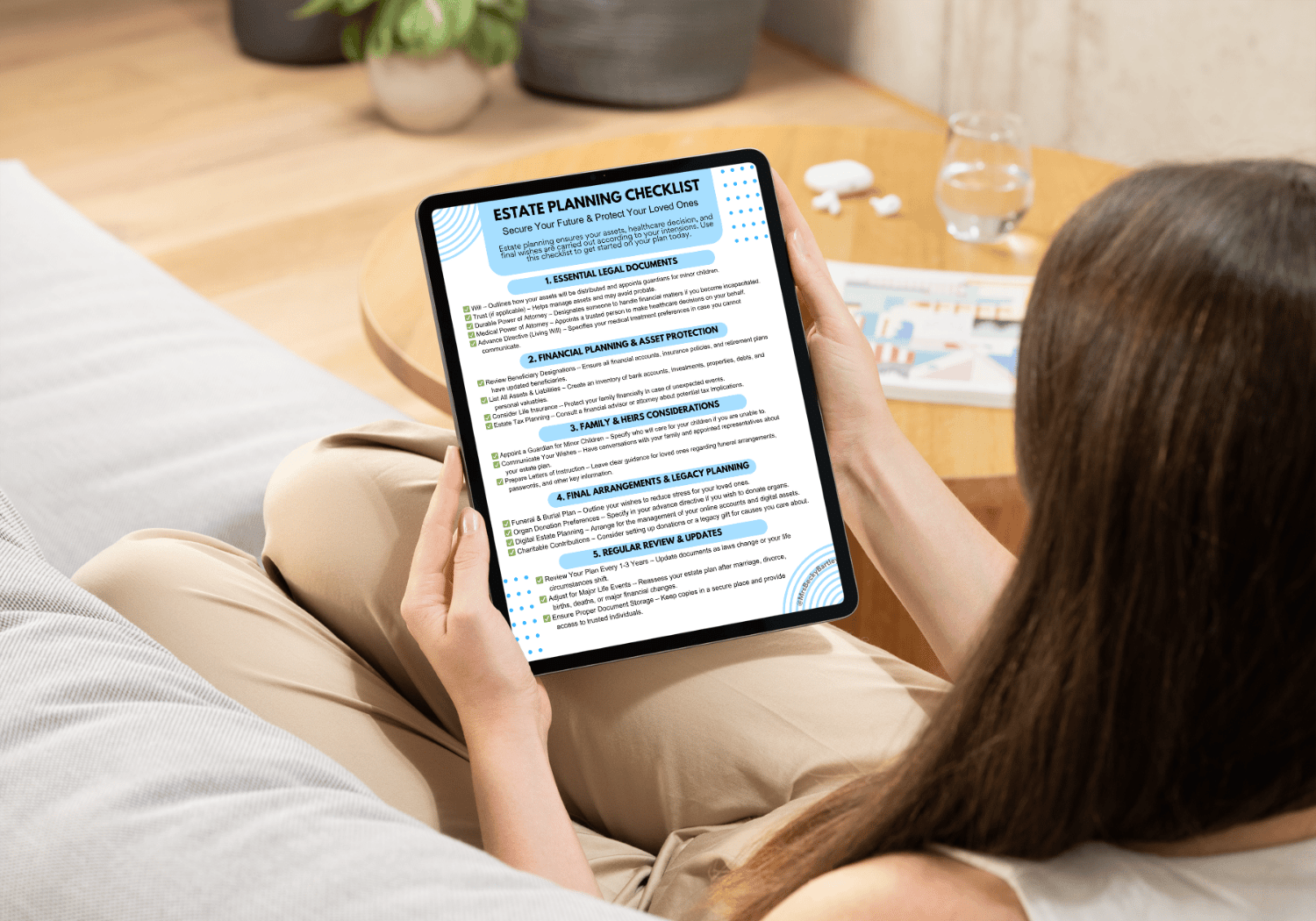

CTA: Start your estate planning today! Download our checklist to make the process easier and schedule a consultation for personalized guidance.

Discover more from Mrs. Becky Bartley

Subscribe to get the latest posts sent to your email.