Planning for the Inevitable: Why It Matters

Talking about end-of-life planning may not be easy, but it is one of the most responsible financial decisions you can make. Without a proper plan in place, your loved ones could be left dealing with legal headaches, financial burdens, and uncertainty during an already difficult time. The good news? With just a few key steps, you can ensure that your wishes are honored and your legacy is protected.

This guide walks you through everything you need to know about wills, trusts, beneficiaries, power of attorney, funeral planning, and more—so that when the time comes, your family has clarity, not chaos.

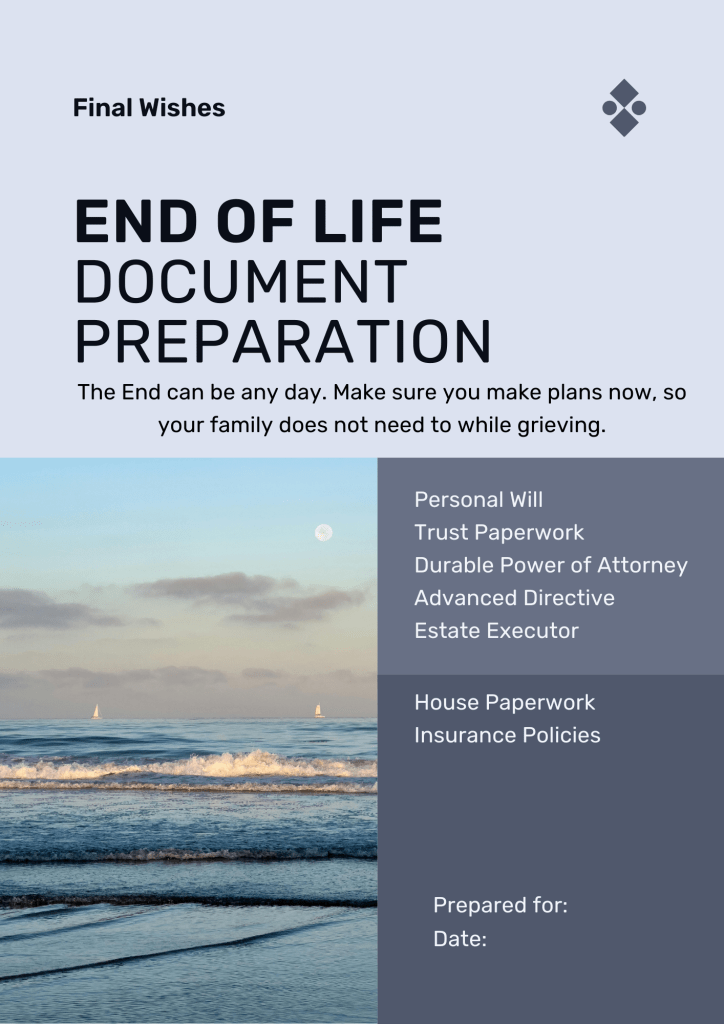

Essential End-of-Life Documents

✅ Will vs. Trust: Which One Do You Need?

A will ensures that your assets are distributed according to your wishes, while a trust can help avoid probate and provide greater financial control. Learn which option is best for you.

✅ Primary & Contingent Beneficiaries

Naming a primary and a backup (contingent) beneficiary for your bank accounts, retirement funds, and life insurance policies helps ensure that your assets go directly to your intended loved ones without delays.

✅ Durable Power of Attorney (POA)

A POA designates someone to make financial and legal decisions on your behalf if you become unable to do so.

✅ Advance Directive (Living Will)

This document outlines your medical care preferences in case you become incapacitated, taking the burden of tough decisions off your loved ones.

✅ Executor of Your Estate

Choose a trusted individual to handle your financial matters, ensuring a smooth transition of your estate.

Financial & Funeral Planning: What You Need to Know

✅ Pre-Planning Your Funeral

Funeral planning in advance prevents your family from making expensive and stressful decisions during their time of grief.

✅ Setting Up a Funeral Fund

Whether it’s a pre-paid funeral plan or a designated savings account, having funds in place relieves the financial strain on your loved ones.

✅ Managing Digital Assets

Don’t forget about your online accounts, social media, and digital banking. Make a secure list of your passwords and account information for your executor.

✅ Organizing Your Important Documents

Create a binder or digital folder with your will, trust, financial statements, insurance policies, and any other key documents in one easy-to-access place.

How to Get Started

1️⃣ Review Your Current Financial & Legal Situation

Take inventory of your assets, debts, insurance policies, and any existing estate planning documents.

2️⃣ Talk to Your Loved Ones

Make sure your family understands your wishes and where to find important documents.

3️⃣ Meet with an Estate Planning Professional

While DIY options exist, consulting with an attorney or financial advisor can help you avoid costly mistakes.

4️⃣ Regularly Update Your Plan

Life changes—marriage, children, divorce, new assets—require updating your will, trust, and beneficiaries to reflect your current situation.

Get Your Free Checklist

To help you get started, we’ve created The Essential End-of-Life Planning Checklist—a simple, step-by-step guide to ensure that everything is in order for your family.

📥 Download it now and start planning for peace of mind.

Final Thoughts

While no one likes to think about the inevitable, proper planning can make a world of difference for your loved ones. Taking control of your financial and legal matters now is a gift that offers security, clarity, and peace.

Blog Posts

The Importance of Updating Your Beneficiaries

April 16, 2025 – Coming soon …

Funeral Planning: Easing the Burden on Your Loved Ones

April 30, 2025 – Coming soon …

Wills vs. Trusts: Which One is Right for You?

April 9, 2025 – Coming soon…

Power of Attorney & Advance Directives: Why You Need Them Now

April 23, 2025 – Coming soon…

Disclaimer: The information provided on this page is for educational and informational purposes only and should not be considered legal advice. I encourage everyone to have open conversations about end-of-life planning and to get their personal affairs in order to help ease the burden on their loved ones during times of grief. Any resources or links shared are for general guidance only. Please consult with a qualified attorney or estate planning professional to obtain legal advice and documents appropriate for your individual circumstances.