As the leaves turn and the year winds down, it’s natural to start reflecting on what you’ve accomplished and where you’ve fallen short. For many, fall is the season of cozy sweaters, pumpkin spice, and holiday anticipation. But it’s also the perfect time to pause, review your finances, and make intentional moves that set youContinue reading “How to End the Year Strong Financially”

Author Archives: Becky Bartley

Switching Gears: Adjusting Your Budget for Shorter Days & Longer Bills

As summer winds down and the crispness of fall settles in, life begins to shift. The days grow shorter, the evenings cooler, and routines change with back-to-school schedules, upcoming holidays, and the end-of-year push at work. These changes aren’t just seasonal—they ripple into your wallet, too. Utility bills climb as the heat or furnace kicksContinue reading “Switching Gears: Adjusting Your Budget for Shorter Days & Longer Bills”

Declutter Your Finances Like You Declutter Your Closet

As fall approaches, it’s time to declutter both your closet and finances. By systematically examining expenses, identifying needs versus wants, and organizing your financial life, you can create space for future goals. Regular financial maintenance is essential for long-term clarity and reduced stress, leading to financial freedom and empowerment.

Labor Day Reset: Fall Into Better Money Habits

Labor Day serves as an ideal time to evaluate and reset personal finances before the busy holiday season. By reflecting on summer spending, refreshing budgets, revisiting financial goals, strengthening savings, managing debt, and preparing for upcoming expenses, individuals can maximize their financial clarity and success for the remainder of the year.

Preparing Your Finances for the Holiday Season Without Going into Debt

The holiday season brings joy but can strain finances. This guide offers practical tips to manage holiday spending effectively. Key steps include setting a budget, creating a gift list, utilizing a sinking fund, shopping smart, limiting extra expenses, communicating with loved ones, preparing for surprises, and focusing on meaningful experiences.

The Summer-to-Fall Money Reset: How to Refresh Your Finances Before the Holidays

As summer ends, it’s time to reassess your finances before the holiday season. Review your summer spending, adjust your budget for fall expenses, revisit financial goals, plan early for holiday costs, save where possible, and refresh your financial mindset. With careful planning, you can navigate the upcoming season without stress.

Back-to-School Budgeting: How to Save on Supplies, Clothes, and More

Back-to-school season brings excitement and stress regarding spending. To save money, start with a list, check for supplies at home, time purchases wisely, take advantage of sales and coupons, buy quality items, involve kids in budgeting, consider secondhand options, and plan for the next year. A little preparation can keep costs down effectively.

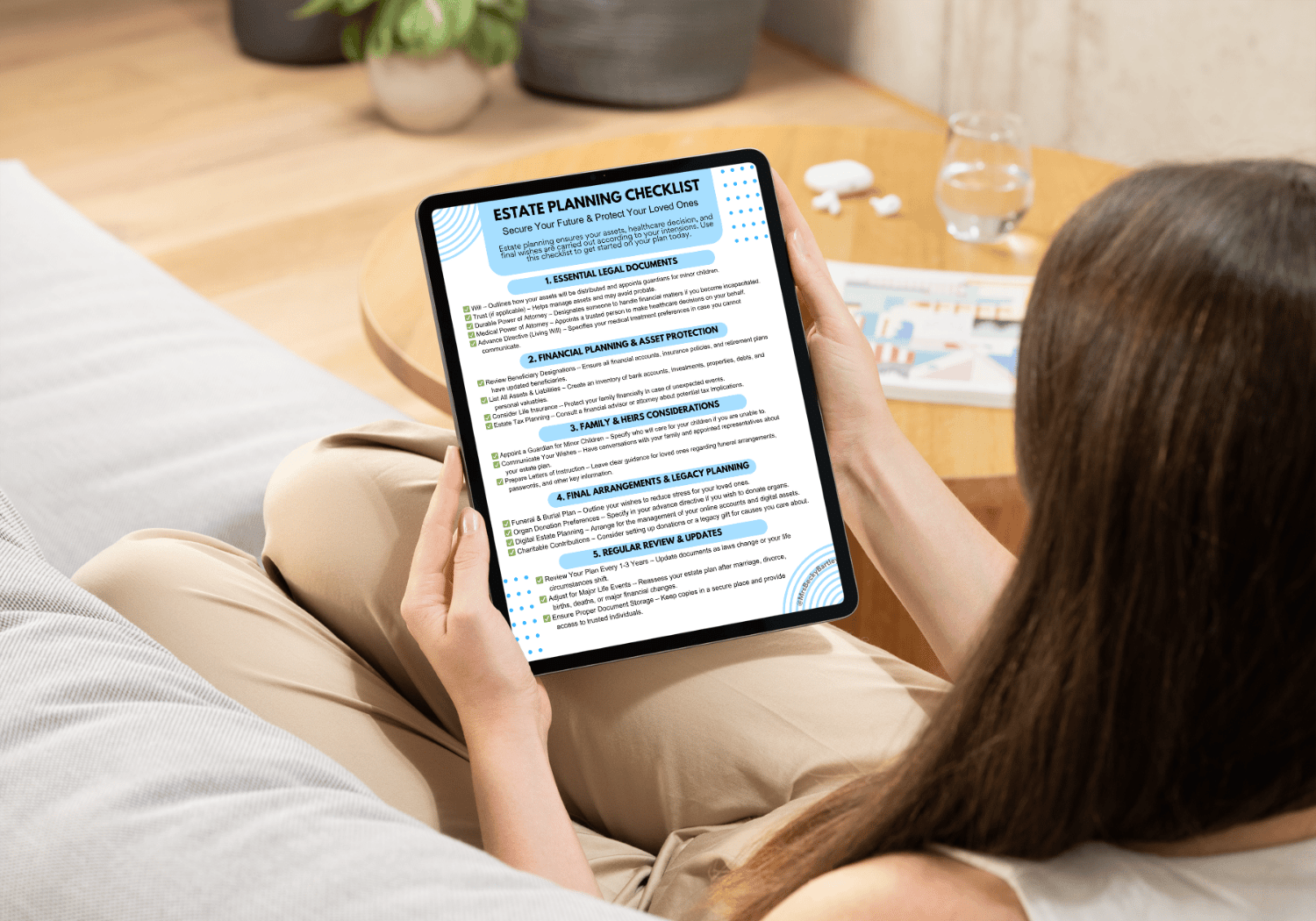

The Importance of Updating Your Beneficiaries

LiLife involves constant changes like marriage and loss, yet updating beneficiary designations on financial accounts often gets overlooked. Beneficiary designations are crucial as they override wills and trusts. Forgetting to update or leaving them blank can lead to serious consequences, including asset disputes. Regular reviews are essential for effective estate planning.

Wills vs. Trusts: Which One is Right for You?

This post discusses the essential differences between wills and trusts in estate planning. Wills distribute assets upon death but require probate, while trusts can manage assets during life and avoid probate. Utilizing both offers comprehensive protection, covering various needs and ensuring beneficiaries are effectively supported. It’s crucial to make timely decisions.

Why Estate Planning is Essential for Everyone

Estate planning is essential for everyone, not just the wealthy. It ensures your wishes are honored and protects your loved ones from legal challenges after your passing. Key documents include wills, trusts, and advance directives. Procrastination and failure to update plans often hinder effective estate planning. Begin today for peace of mind.