When buying a house, maintaining financial stability is essential. Key do’s include stable employment, timely bill payments, low credit card balances, saving for unexpected expenses, getting pre-approved for a mortgage, and monitoring and maintaining your credit score. Don’t change jobs, make large purchases, apply for new credit, close credit accounts, miss payments, or overextend yourself financially. These actions can derail your home purchase, causing delays or loan denial. Careful financial planning and stability are crucial for a smooth home-buying process.

Author Archives: Becky Bartley

Home Buying Financial Preparation: Costs, Tips, and Advantages

Buying a house is a major life milestone requiring financial preparedness. First, assess your financial health by checking your credit score, evaluating savings, and managing debts. Understand the costs of purchasing a house, including down payments, closing costs, moving expenses, and more. Building an emergency fund and getting pre-approved for a mortgage are crucial steps to a smooth home-buying journey.

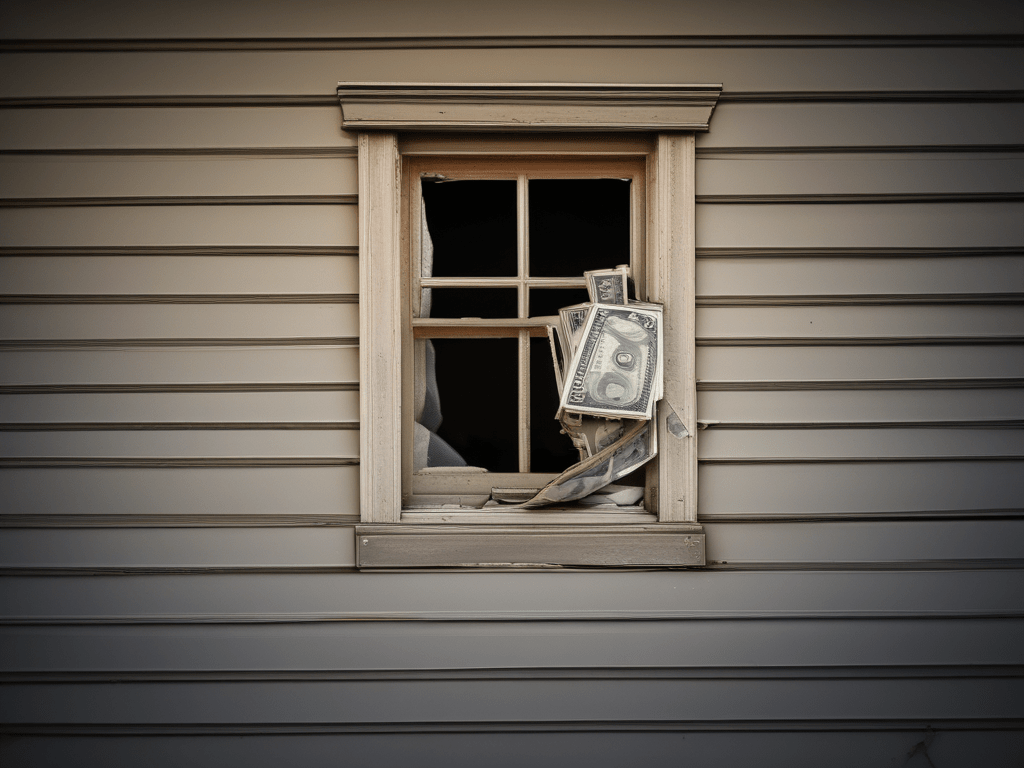

Murphy’s Law Strikes Again: The Importance of an Emergency Fund

In today’s post, the importance of building and maintaining an emergency fund is underscored through real-life examples. An emergency fund provides immediate access to funds, prevents debt accumulation, reduces stress, and improves financial stability. Tips for building an emergency fund include setting a savings goal, automating savings, reducing unnecessary expenses, and staying disciplined.

Struggling with Balancing Your Budget? Let’s Find Your Path to Financial Freedom!

Struggling with budgeting and mindset challenges? You’re not alone! I can guide you towards financial peace and freedom. Together, we’ll create a personalized budget, track your spending, achieve financial goals, build an emergency fund, and eliminate debt. With my support, let’s shift your money mindset and make your money work for you!

The Importance of Emergency Funds: Your Safety Net in Times of Need

In our budgeting journey, let’s prioritize building an emergency fund. This safety net provides peace of mind and shields us from unexpected financial blows. Start small, set a goal, and be consistent. With discipline and dedication, we can create a buffer against life’s uncertainties, ensuring a more secure financial future.

Free Up Your Time and Focus on What You Love: The Benefits of Hiring a Bookkeeper for Your Small Business

Are you a small business owner trying to do it all and never finding enough time to give the books the attention they deserve? 📚⏳ I can help give you back some time! I will focus on your books while you focus on what you were meant to do – running your business! 🚀💼 Remember, you started your business to do what you love. Let me handle the rest! 💪✨

The Hidden Dangers of Afterpay: How Small Payments Can Add Up to Big Financial Stress

Hey there! Today, let’s talk about a popular trend that promises convenience but can lead to financial pitfalls: afterpay and similar payment installment programs. While these services allow you to break up larger payments into smaller, manageable chunks, they can quickly derail your monthly budget if not used cautiously. Let’s delve into why these seeminglyContinue reading “The Hidden Dangers of Afterpay: How Small Payments Can Add Up to Big Financial Stress”

Mastering Your Monthly Finances: A Deep Dive into Understanding Your Bills

Hey Everyone! Welcome to another insightful discussion about managing your monthly finances. Today, let’s dive deeper into understanding your bills and how they impact your financial picture. 1. Understanding Your Net Income It’s crucial to start by understanding your net income—the amount you take home after deductions like taxes. While your gross income may lookContinue reading “Mastering Your Monthly Finances: A Deep Dive into Understanding Your Bills”

Conquer Your Budgeting Fears: A Call to Action for Financial Empowerment

Many struggle with budgeting, feeling fear and overwhelm. Identifying specific fears and seeking support are crucial. Various resources, from blogs to coaching, can help. Join the conversation, share your challenges, and shape financial education. Conquer budgeting fears together for a brighter future.

Smart Money Moves: How to Save Big and Boost Your Income

Are you ready to take control of your finances and make meaningful strides towards financial freedom? In today’s blog post, we’re exploring practical strategies for saving money, cutting expenses, and boosting your income to tackle debt head-on. Whether you’re looking to pay off student loans, medical bills, or credit card debt, these tips will helpContinue reading “Smart Money Moves: How to Save Big and Boost Your Income”